Manage the Insurance Verification process and Reduce Claim Denials with Elixir

What is the Insurance Verification process?

Insurance verification is a very importance process in the healthcare industry. With majority of the people relying on health insurances for covering their medical bills, it has become all the more crucial that healthcare providers understand the importance of the insurance verification process.

In simpler terms, insurance verification process primarily is the process of contacting the concerned insurance agency to ensure that a patient’s healthcare benefits cover the requested procedures and services. It is also to be noted that most people do not really understand their health insurance policies entirely and have a hard time ascertaining the coverage related technicalities. Hence, the onus of insurance verification falls on the medical practices to ensure that the treatment and services are properly reimbursed.

An ideal insurance verification process has several steps which can be briefly described as follows:

1. Patient Scheduling: Patient scheduling is the first touchpoint in the insurance verification process. Once the meeting schedules of the patient are confirmed and the medical providers are ready for the process – the onset of the insurance verification process occurs.

2. Enrolment: The next step is to capture all the necessary demographic and insurance related information. Medical providers usually have a list of the information required and they strive to have all the necessary information recorded during this step.

3. Insurance Eligibility Verification: The eligibility verification step requires the medical providers to coordinate with the relevant insurance companies for checking and validating the patient information. If the eligibility verification process is rightly done, many serious issues such as delayed payments, rework, decreased patient satisfaction, increased errors, and bad debt can be avoided.

4. Authorization: Once the insurance eligibility of a patient is verified, the next step is to obtain the authorization of claim for the treatment from the insurance company.

5. Follow up with the patient: There then needs to be scheduled follow up meetings with the patient so that any missing information is readily obtained, and the patient database is updated accordingly.

6. Sync with Billing System: In the next step, the information collected from the patient and the insurance company is updated in the billing system used by the medical provider.

7. Claims Transmission: Lastly, approval for the request from the insurance provider is obtained in order to proceed with the reimbursement process.

Importance of Insurance Verification in the Healthcare Industry

Insurance eligibility verification is indeed very important for healthcare providers and the following pointers briefly highlight the importance of this process:

1. Determination of the patient eligibility at the right time provides a transparent view of the insurance coverage.

2. Healthcare providers are able to submit accurate claims when the eligibility verification process is carried out well.

3. Any chances of claim re-submissions and rejections due to patient demographic or eligibility related details are minimized.

4. Healthcare providers are able to optimize their cash flow by avoiding claim denials and bad debts.

5. The patient responsibility is ascertained correctly and the same is then intimated to the patient. Nine out of ten patients want to know their payment responsibility as soon as possible. The transparency in communication significantly increases patient satisfaction.

6. The insurance companies make regular updates in their policies and health plans. It is imperative for the medical providers to verify the repercussions of these policy changes on a regular basis.

Repercussions of an inadequate verification process

Millions of claim denials occur because the insurance verification has not been completed correctly or there is no coverage for the patient under the availed plan. Findings from Remit Data, claims that two of the top five claim denial reasons were insurance coverage related –the culprit being insurance eligibility verification. It is also to be noted that the rework process for each claim can costs anywhere between $20 – $30.

Having talked about the importance of the insurance verification process, we now need to understand the possible outcomes for healthcare providers when the verification process is flawed. A few repercussions of flaws in the eligibility verification process can be highlighted as follows:

1. Errors in the eligibility verification process can lead to claim denials and rejections.

2. In case of re-submissions, the rework process can result in significant delays in the treatment and can lead to wastage in terms of financial resources as well. As stated earlier, the rework process can cost anywhere between $20-$30 per claim.

3. Patient satisfaction can be negatively impacted if the insurance verification process is flawed. Any delays in the treatment can result in aggravated patients.

4. The situation worsens in case the patient responsibility is not communicated to the patient before the treatment ensues. The patient might deny having enough money to pay for the treatment which can then result in bad debt.

5. Since insurance policies and plan change frequently, failure to be in tune with these regulatory changes can lead to frequent denials.

Elixir – The One Stop Solution for all your Insurance Verification needs

Elixir definitely understands the importance of the Insurance Eligibility Verification process and makes sure that the entire verification process runs smoothly. Let’s see how Elixir effectively manages the insurance eligibility verification process in the upcoming points.

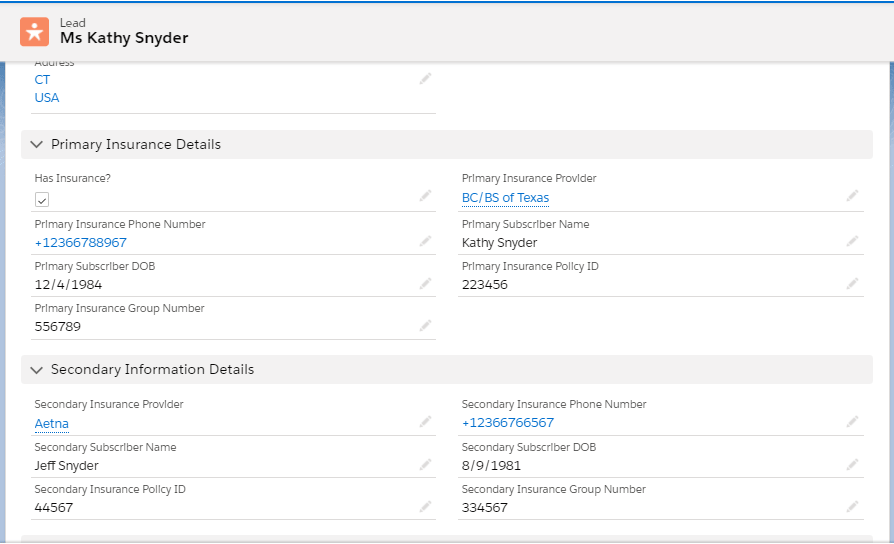

1. Patient Information: Elixir is built on Salesforce and uses the standard features of lead and opportunity management for effectively capturing patient data. All of the necessary information for unqualified and qualified leads can be easily managed at the lead or the opportunity level.

As can be seen in the image, any kind of information can be collected, and the same information will be available for every person involved.

2. Insurance Verification information and workflows:

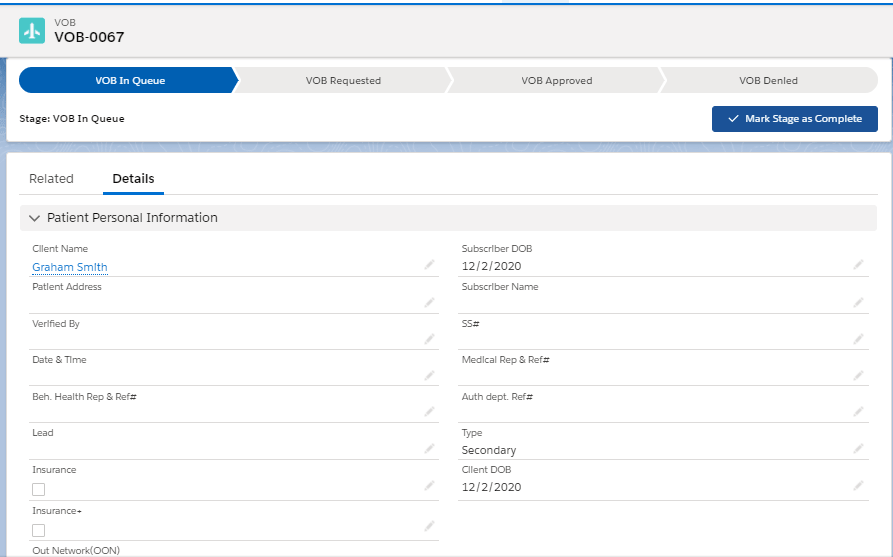

Apart from the patient demographic data, insurance related information can be recorded at the VOB or Verification of Benefit level. Any number of VOB records can be created for each patient and similarly any kind of insurance data can be recorded for ensuring a smooth verification process.

As can be seen in the image attached above, there are several VOB stages which can be easily used for tracking the progress of the insurance verification process for each patient. When the progress is strictly tracked, the risks for claim rejections get minimized.

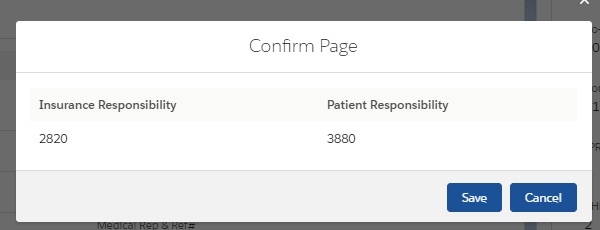

3. Cost of Care Calculation: It is very important that the patients are aware of their payment responsibilities to avoid bad debt. Elixir understands this and has an inbuilt cost of care calculator for assessing the insurance and patient payment responsibilities based on standard rates.

Once the respective payment responsibilities are assessed, it becomes easier to avoid bad debts and this transparency also increases patient satisfaction significantly.

4. Integration with Insurance companies: Elixir helps in effective integration with insurance companies for accurate eligibility verification. Elixir also has the capability to receive these verification reports which can then be analysed for further processes.

5. Sync with Billing System: Elixir has a separate Revenue Cycle Management (RCM) module built on Salesforce Platform for taking care of all the Billing related needs of the provider. Alternately, Elixir can be integrated with any third-party billing platform for maintaining the billing & payment database of the patients.

Read more about Elixir Billing capabilities in the blog: Upgrade your old RCM with the Next-Gen Elixir Billing, built on Salesforce to increase profitability.

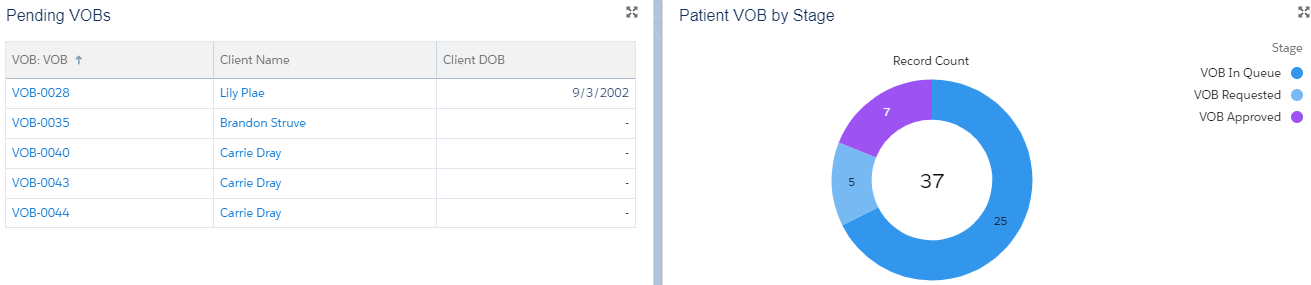

6. Intuitive Reports and Dashboards: With all the patient and insurance related information in picture, standard reports and dashboards can be created for tracking the progress of the insurance verification process and having a better visualization of the verification related data.

Having talked about all the ways in which Elixir helps with the insurance eligibility verification, it can be concluded that Elixir is definitely a much needed solution for avoiding issues such as claim rejections, bad debt and delay in treatment procedures.

Having talked about all the ways in which Elixir helps with the insurance eligibility verification, it can be concluded that Elixir is definitely a much needed solution for avoiding issues such as claim rejections, bad debt and delay in treatment procedures.

Want to see how Elixir is the right fit for your organization? Fill out the Contact Form and the Elixir team will contact you within 24 hours!

Recent Posts

Upgrade your old RCM with the Next-Gen Elixir Billing, built on Salesforce to increase profitability

Categories

Recent Comments

Archives

- February 2025

- November 2024

- July 2024

- April 2024

- February 2024

- November 2023

- September 2023

- August 2023

- February 2023

- January 2023

- July 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- March 2021

- December 2020

- November 2020

- October 2020

- May 2020